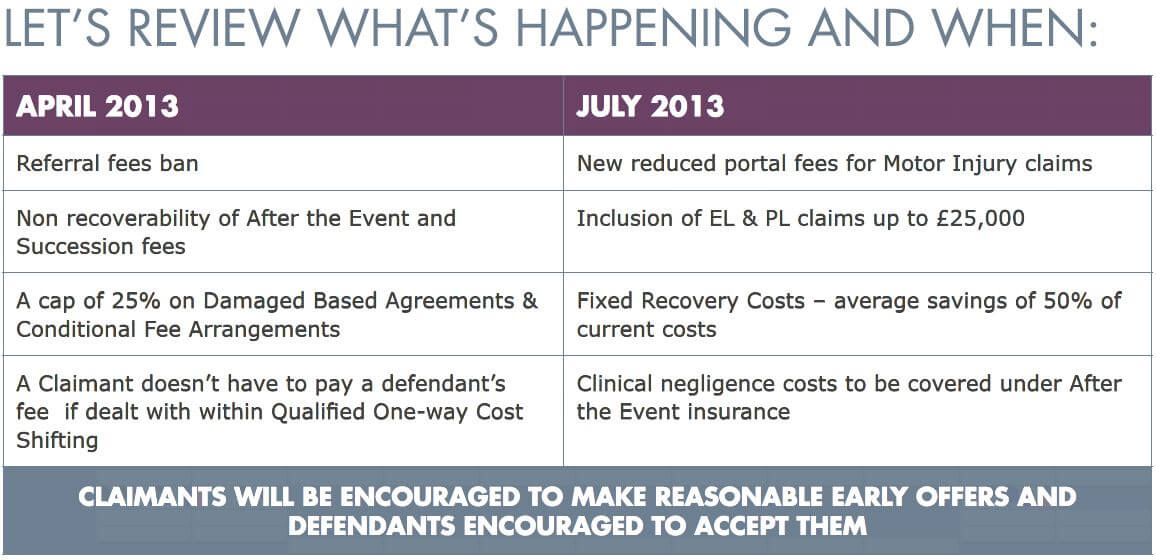

Update on the MOJ Portal changes 2013

The Ministry of Justice has reviewed the Civil Procedure Rules (CPR) to bring them in line with the pre-action protocols practised in relation to motor accidents. Currently with motor claims, claimants’ solicitors drop their formal letter of claim onto a web portal to notify Insurers of the claim.

As of the end of July 2013, Employers’ Liability (EL) and Public Liability (PL) up to the value of £25,000 will be included in the Claims Portal. The aim is to speed up the process for claimants and to control costs.

Insurers will have a reduced amount of time to confirm their stance on liability as follows:

EL = 30 days

PL = 40 days

Motor injury claims will remain at 14 days.

How do the changes affect you?

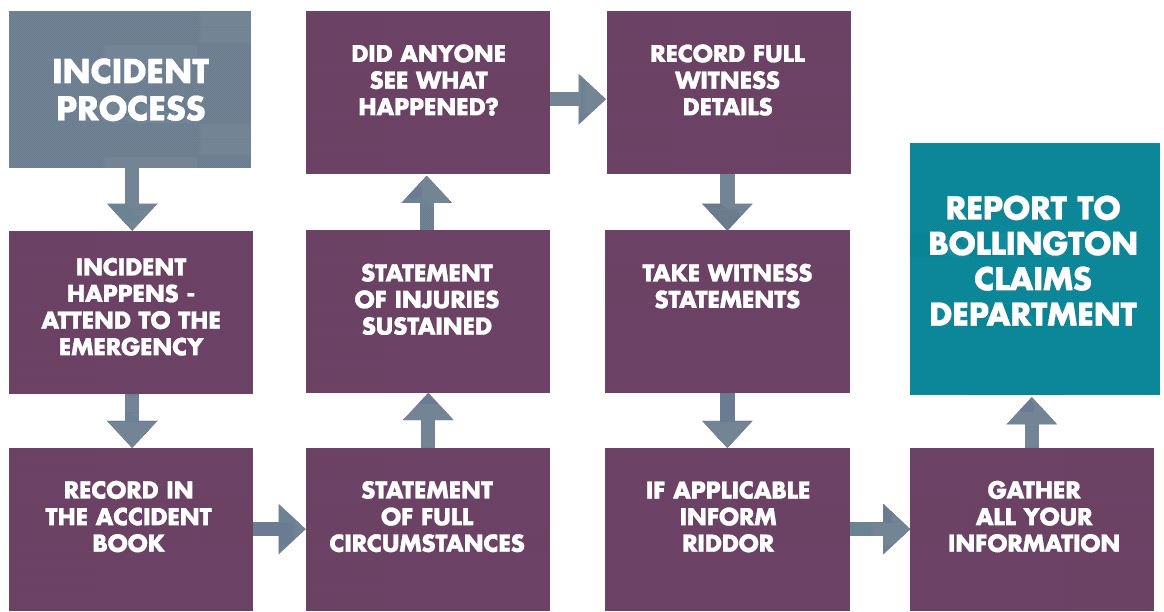

Insurers have to adhere to strict MoJ protocols and prompt reporting of incidents will be key. You can make a difference by:

- Reviewing your internal claims process with our internal claims department

- Reporting incidents as soon as possible to Bollington’s claims department

- Follow the EL & PL checklist. Please call 01625 400205 or email claims@bollington.com for a copy of the checklist

- Follow our incident process flowchart:

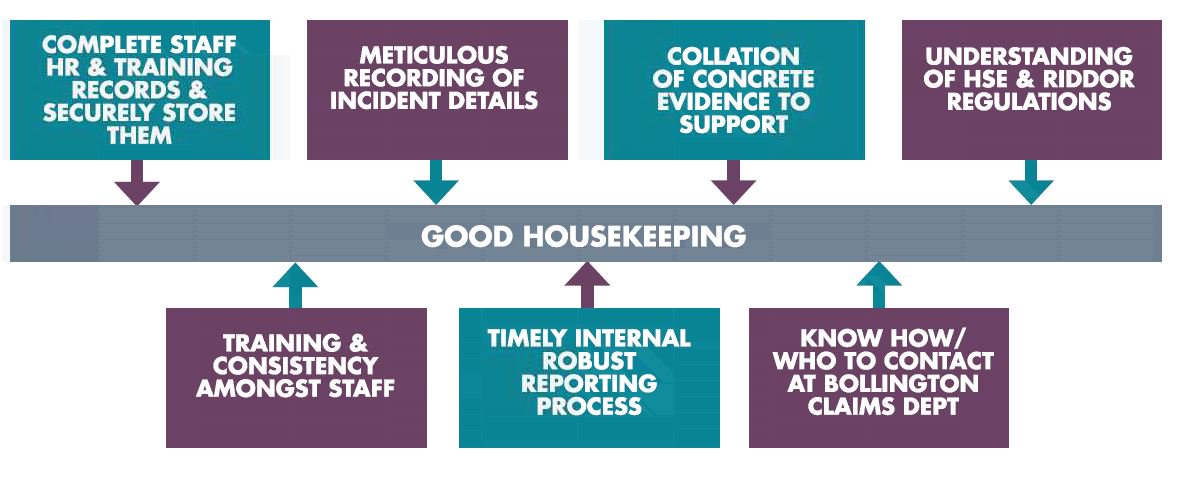

How can we help as your broker?

- We work with insurers and clients to make the pieces fit as quickly as possible

- We collate all the information, support, educate and guide you every step of the way

- Practice our Good Housekeeping Rules at all times:

Summary

We need to embrace the changes quickly and follow good working practices to ensure we are ready to deal with a claim as soon as it is received. We all need to work together to achieve this outcome.

The emphasis is not to sit and wait for a formal letter of claim as potentially you will be the last to know that a claim has been dropped into the MOJ Claims Portal.

Forewarned is forearmed!

Best practice is to advise of all incidents and we can pass the responsibility of managing the claim to a speedy conclusion to your insurer.

- If insurers feel they don’t need to investigate, they will keep a record of the incident for information only

- Insurers can only take action if they are aware