As your insurance broker, our aim is always to reduce the risks your business faces and help you out wherever we can.

Right now, we’d like to offer the benefit of our experience and help you make informed decisions in tough times.

Here, we offer our advice to help you consider issues you might not have thought of, in order to ensure the long-term future of your business once this crisis has subsided.

Do the right things now. Protect yourself and your business in the long-term.

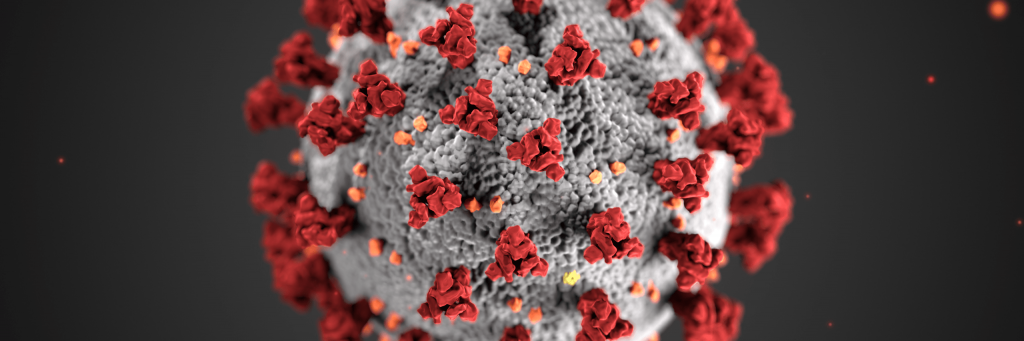

In the light of the coronavirus outbreak, businesses of all types, sizes and persuasions are suffering. Business owners and senior managers like yourself are rightly very concerned.

You need to react with regard for your staff, customers and your supply chains – and ultimately, the future of your business.

When your livelihood is on the line, it’s an exceptionally stressful situation. You want to be decisive and provide clear direction, but your actions need to be taken with due consideration of their impact on everybody involved.

This isn’t always easy, especially when information is limited, and snap decisions need to be made.

See issues coming, and you can prepare for them – meaning your business can get back up-to-speed as soon as possible when circumstances return to normal.

3 things you should carefully consider:

As your insurance broker, we’ve seen many issues and claims raised over the years. With the current situation, we’d like to help you to take a step back and make the right decisions for everyone, as quickly as possible. This should help you to avoid being held personally responsible for things that could go wrong.

1. Protecting staff and mitigating the chances of infection.

This seems obvious during a pandemic, but it’s so important to get it right.

Business owners have a duty of care for their employees. Employees may raise a claim against your business, or against you personally as a senior business manager or owner, for alleged wrongdoing.

Like all businesses, Bollington has had to act quickly in light of current circumstances, following government and scientific advice to protect our staff while maintaining a good quality of service.

As things stand, any business that can safely get staff working from home wherever possible should do so. It’s what we’ve done in our business, with 90% of our staff already working from home at the time of writing, and more to follow.

For employees remaining in their normal workplace, it’s very important to follow the guidance to employers and businesses about Covid-19 that is published by the UK government. This is frequently updated. Follow guidance to the letter, and employees and the wider public will remain safe, reducing any cause to hold you responsible for any illness that arises.

If claims are made against you personally, an employee will need to prove you are legally liable for them contracting Covid-19. You could be covered for claims of this nature through a directors’ and officers’ insurance policy.

2. Following the correct HR processes and procedures with staff.

Even with government assistance, business owners everywhere have been forced to make difficult decisions. These have included redundancies, enforcement of staff holidays, reductions in pay, and sending home some of their workforce, amongst other measures.

This is before accounting for contracted staff who are self-isolating or have been diagnosed with Covid-19, who will look to businesses for sick pay before they can return to work.

High-profile social media messages like this one only intensify the pressure on businesses, who are making never-before-taken decisions to try and keep themselves viable:

If your company is remaining open with no good public health reason to do so, and making you go to work against Govt. orders, let me know. Need to expose the bosses putting money before lives.

— Piers Morgan (@piersmorgan) March 24, 2020

It’s therefore imperative that, in following a course of action, you pursue the right procedures and get the right employment law advice where required. It’s one thing making decisions to protect your business – it’s another thing carrying them out correctly. You need to avoid the risk of employees taking action against you.

The last thing anyone wants is to be held personally responsible by an employee for making an incorrect judgement call – whether that’s breaching the terms of an employment contract, making errors with sick pay, or failing to follow defined redundancy procedures.

Again, the government is on hand to provide ongoing advice on this matter. For example, there are guidelines on following statutory sick pay protocols in this situation.

It’s worth bearing in mind that class action lawsuits may be filed following the current situation – not something you or your company will want to see happening. Employment practices liability insurance can help you in these circumstances.

3. Keeping a calm disposition and documenting activity.

There is so much to think about right now that it’s worth producing a checklist of things that you will need to follow up on later to avoid undue pressure on your business when a semblance of everyday normality is restored.

These include things like:

- Making a note of when HMRC tax repayment breaks end, and ensuring any tax returns are submitted correctly and on-time

- Noting all payment holidays that have been granted, and the financial terms agreed upon resumption of payments

- Ensuring government financial aid reaches its intended subjects – e.g. making sure furloughed workers receive the 80% of their salary (up to £2,500) that the government has agreed to pay them

- Ensuring that you stay on top of regular checks required on tools and equipment your business uses to operate, as and where possible

- Making sure fellow business owners, directors and senior managers act in line with agreed practices and protocols to ensure decisions made are all accounted for

Following advice to remain accountable for all the actions of your business will reduce the chances of employees, HMRC or the HSE pursuing successful claims against you, either through directors’ and officers’ cover or corporate legal liability insurance.

You want to avoid issues when business resumes in the normal manner. Make sure you protect yourself and your business against claims on your insurance when that happens.

Mistakes will be made. Speak to us about how we can help.

Even when you act with the best of intentions, things can go wrong.

For further help and advice with any of the issues raised, and how you can be covered with the right insurance for your needs, please get in touch with your Bollington account manager. We’re here to assist you throughout the coronavirus crisis.

Looking forward to a brighter future

We sincerely hope that all businesses we work with ride out the current situation and come back stronger and better in the long run. We are all concerned about how this situation impacts upon us, but those business owners who do the right things now put themselves in good stead to keep their business as a going concern.

After the threat of coronavirus has subsided, we want everybody we work with to survive and thrive. We hope our straightforward advice can help towards achieving that.