No matter how bright the future looks for your business, you never know when disaster will strike.

Whether it be a flood or destructive building fire, it is vital to have proper insurance policies to protect your business from any interruptions—especially if you are a smaller business with minimal financial flexibility. As a result, many businesses purchase business interruption (BI) policies for peace of mind in the event of unexpected disaster.

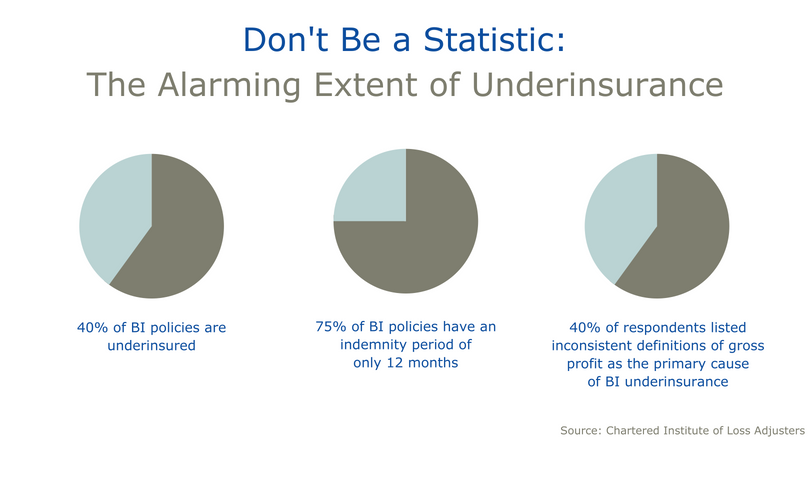

However, what happens when your BI policy fails to cover the entirety of your company’s financial loss? Unfortunately, this scenario is a common occurrence for businesses across the UK. The Chartered Institute of Loss Adjusters (CILA) found in recent research that 43 per cent of BI policies are underinsured by an average of 53 per cent. The following list contains the leading causes for BI underinsurance, as well as tips to remedy the problem:

- Insufficient indemnity periods—Approximately 75 per cent of BI policies have an indemnity period of 12 months, according to industry research. However, one year is usually an unrealistic expectation for a business to have fully recovered after a disaster. To combat this issue, be sure to calculate and set a realistic indemnity period that gives your business an appropriate time span to reach financial stability. This period typically falls between 18 and 24 months.

- Inadequate sums insured for BI policies—Often, inadequate insurance sums for BI policies stem from outdated, roughly estimated or altogether incorrect valuations on commercial properties. It is important that you think about rebuild costs when calculating your BI policy. In addition, complete an annual review of your policy with your broker to ensure the accuracy of your valuation as your business (and your property) develops and changes throughout the years.

- Failure to include wages in the gross profit calculation—In the CILA survey, 2 out of 5 respondents listed inconsistent definitions of gross profit as the primary cause of BI underinsurance. The average definition tends to exclude staff wages and utility costs, while for insurance purposes, those are crucial to calculating an appropriate gross profit. Make sure your gross profit calculation is accurate by including staff and utility costs.

Bollington can help you get it right

Bollington has been insuring businesses of all shapes and sizes for 45 years. We pride ourselves on taking the complexity out of insurance and managing your risks, so we can help to ensure that you get the right level of business interruption insurance to meet your specific needs.

When it's time to renew your insurance, speak to us about cost-effective and affordable BI cover as part of your policy. Call the business insurance team on 01625 400206 to discuss your insurance needs.